Understanding Foreign Exchange Trading

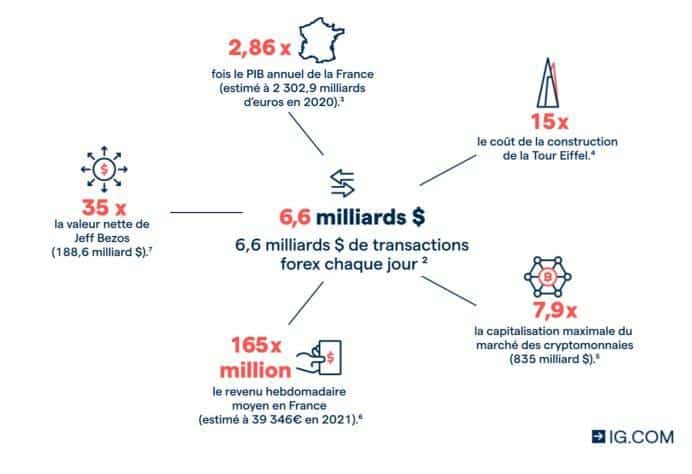

You have probably heard that the Forex market is the largest financial market in the world. The Bank for International Settlements (BIS) found that the foreign exchange market accounts for $6.6 trillion in daily trading volume. The NYSE - the world's most active stock market - has a daily trading volume of only $18.9 billion.

You may be kicking yourself right now for not learning about this huge financial market, and we're here to tell you about it. But remember to be careful, because the Forex market is risky and there are more losers than winners - it is estimated that about 90% of traders lose money.

However, understanding this is a good starting point for joining the other 10% club.

Understanding Forex

If you have ever traveled to another country, you will have had to exchange your currency for the local currency. For example, if you're traveling from France to the UK, you'll need to convert your Euros (if you had cash) into British pounds. It's the same concept in Forex, except you do the exchange online.

Forex traders essentially do the same thing, except this time they do it for speculative purposes. Speculation means that you have no real need for the currency you are trading, but you want to profit from the change in its value. For example, if you think the pound will appreciate over time, you will use your Euros to buy pounds which you will then convert back into Euros later when the value of the pound has risen enough.

Currency Ratings

In the foreign exchange market, currencies are assigned a three-letter symbol known as the ISO 4217 currency code established in 1973 by the International Organization for Standardization (ISO). The first two letters represent the name of the country and the third letter is the name of the local currency. For example, the U.S. dollar is represented by USD while the Canadian dollar is represented by CAD. The Euro (EUR) is unique in that it represents both the region (Europe) and its currency.

These currencies are also given nicknames by traders for easier identification, for example:

- Buck for the US dollar

- Cable for the pound sterling

- Fiber for the Euro

- Loonie for the Canadian dollar

- Swissy for the Swiss franc

- Aussie for the Australian dollar

Currency pairs

The first thing you will notice when you start trading is that currencies are not listed individually, but rather in pairs, such as the EUR/USD. This pair simply represents the price of one currency against another. In this case, the EUR/USD pair compares the relative value of the Euro to the US dollar. So when you buy the EUR/USD pair, you are essentially buying the euro while simultaneously selling the US dollar. The currency on the left is the base currency while the currency on the right is the quote currency.

Imagine that you are traveling from the United States with U.S. dollars in your wallet to France, where the euro is the local currency. When you exchange your dollars for euros at the airport, you simultaneously sell your dollars to buy an equivalent amount in euros. On the way back, you do the opposite by selling the EUR/USD pair - selling euros for U.S. dollars. That's foreign exchange trading in a nutshell, and that's what you'll do when you perform the same transaction from your phone or computer.

Currency pairs are classified into three different categories based on how often they are traded. The U.S. dollar is the most traded currency in the world, so it is the most widely traded and is a constituent of the seven major currency pairs.

- EUR/USD

- USD/JPY

- GBP/USD

- USD/CHF

- USD/CAD

- AUD/USD

- NZD/USD

They are called the major currency pairs because they are the most liquid. Liquidity refers to how often an asset is traded and how easily it can be converted. For example, although the real estate market is huge, it is considered illiquid. In contrast, with the U.S. dollar involved in nearly 80% of all foreign exchange trading, these currency pairs are highly liquid, hence their title of "majors." They are so heavily traded because these countries have close economic ties and many transactions take place between them.

The second category of Forex pairs is known as minors. They are not as frequently traded as the majors, but they still have a lot of trade and therefore are moderately traded. Here are some of them:

- EUR/GBP

- EUR/CHF

- EUR/JPY

- GBP/CAD

- CAD/JPY

Finally, we have the exotic pairs, so called because at least one of the currencies in the pair is from an emerging economy country. In theory, there could be one currency pair for each country, but there would be too many pairs to list. So the main exotic pairs are those for Mexico, Brazil, Turkey, South Africa, China, Russia and a few other countries. Here are some of them:

- USD/HKD

- USD/ZAR

- USD/MXN

- USD/RUB

- USD/BRL

The Forex market

One of the main differences between the foreign exchange market and the stock market, for example, is that the former operates 24 hours a day from Monday to Friday, while the stock market, such asEuronext Paris, opens in the morning and closes in the afternoon.

This is mainly due to the overlapping time zones in the different countries, which makes the market split into trading sessions. In addition, as countries have different cultures and holidays, the market remains open and trading continues.

Forex "starts" with the Sydney session between 10pm and 7am UTC and continues with the Tokyo session (12pm to 9am UTC), the London session (8am to 5pm UTC) and finally with the New York session (1pm to 10pm UTC). In fact, although the market is closed over the weekend, the late session in New York and the early session in Sydney mean that there are less than two days when the market is closed.

Another unique feature of the Forex market is that it is not run by an exchange. Foreign exchange transactions are made directly between buyers and sellers. This is known as the over-the-counter (OTC ) market , as transactions do not go through a central operator.

Terms you need to know

- Spread - this is the difference in price between the bid price and the ask price. The bid price is the maximum amount buyers are willing to pay for a currency, while the ask price is the minimum amount sellers require to sell.

- Lot - a lot is the standard quantity or unit of currency that can be traded. Even on a market like the COMEX, the minimum amount of gold you can buy is 100 troy ounces. In the foreign exchange market, the standard lot size is 100,000 units, but there are also mini lots (10,000) and micro lots (1,000).

- Leverage - leverage is essentially the process of borrowing funds to open larger positions than your capital allows.

- Margin - although it offers leverage, the broker will ask you to make a down payment, called margin.

- Pip - short for "percentage in point", this is the standard change in price of a currency pair. Most pairs are quoted to 5 decimal places, such as 1.11245, with the 4th digit representing the pip value. From 1.11245 to 1.11260, the change is 1.5 pip.

How does Forex work?

For the foreign exchange market to develop, several players must be involved.

Forex Brokers

While the foreign exchange market is indeed the largest financial market, many often forget how small the retail segment is. FX swaps account for the majority of trading volume, while the spot market accounts for $2 trillion per day. Even then, the retail trader segment is estimated to be between $200 and $300 billion, which means that it is a small part.

With this in mind, it is obvious that the biggest players in Forex are the large banks and multinational companies that use multiple currencies. These companies trade billions of dollars every day, which is why the Forex market has become so important, and they would have no need to trade with an individual with little capital.

Yet we continue to trade with a capital of $100 or less thanks to Forex brokers. The broker provides the link between you and the interbank market, allowing you to trade in the foreign exchange market. They do this by partnering with some of the largest banks to access this interbank market with their vast resources.

The largest Forex brokers have hundreds of thousands of clients. So even though each client has only $1,000 in capital, together these funds represent a significant amount of assets under management (AUM). This gives Forex brokers leverage and access to the interbank market, allowing you to trade with the world's largest banks.

In return for their effort, Forex brokers charge either a spread, a commission, or both. The spread, as we described in a previous section, is the difference between the bid and ask prices. For example, if the EUR/USD exchange rate is 1.11245, the broker will represent it as 1.11245/1.11255. The difference between these two values is the spread (1 pip). This difference is paid by the individual trader on each trade.

Commission-based pricing is simpler, simply a fixed percentage charged based on transaction volume.

Trading Platforms

Before the internet, traders had to call their broker to place buy and sell orders. But technology has made it possible to conduct all activities from your computer or smartphone. Your broker will provide you with a terminal to access the foreign exchange market, and it is through this terminal that you will receive market quotes and send your orders.

There are a number of trading platforms. Brokers pay annual license fees to platform developers, so it is not practical to provide all trading platforms. Nevertheless, the best Forex brokers offer at least two platforms to meet the needs of traders.

What is a Forex trading strategy?

You will often hear that the key to success in Forex trading is to have an effective strategy. Every business needs a plan to be executed properly, otherwise it would be chaotic. This is true for Forex trading, and perhaps even more so, because it is your money that is at stake and therefore you need a trading plan or strategy.

Therefore, you must have a systematic method of approaching the markets for every trade you make. There are many considerations that need to be taken into account, including:

- The size of your positions - it is recommended that you do not trade more than 2% of your total capital to avoid significant losses.

- The level of le verage - high leverage can lead to higher profits, but also higher losses if the trade goes wrong.

- Currency pairs to trade - major pairs have tighter spreads and are more liquid than minor and exotic pairs.

- How long to keep a position open - the longer you keep a position, the more profit you can make.

- Stop Loss Level: It is important to quickly cut losing positions to protect your capital.

- Technical indicators to use - there are dozens of indicators and you should choose the ones you are most comfortable with.

- Manual or automated trading: each has its advantages and limitations, but Forex market participants are increasingly moving towards automation.

It takes time to develop an effective trading strategy, which can only be done with practice. Most brokers offer a demo account that uses virtual funds while providing the full trading experience. It's a bit like pilots using a flight simulator to practice flying a plane before they take off.