Discover its technology and applications

It's hard to browse the web or follow financial news without cryptocurrencies being mentioned these days. Indeed, crypto-currencies have been one of the most exciting developments of the last decade, revolutionizing the way we think about finance and communication. But to the extent that cryptos are mentioned so often by enthusiasts and experts, many people still don't know what they are.

We're here to remedy that, explaining what a cryptocurrency is, how it works, and how you can get started today.

Brief history of cryptocurrencies

The most famous cryptocurrency is Bitcoin, which was launched in 2009 by a developer using the pseudonym Satoshi Nakamoto. To this day, no one knows who the creator of Bitcoin actually is, although some personalities have claimed to be Nakamoto. What we do know is that he owns about 1 million Bitcoins, which would value him at about $21 billion at the time of publication.

However, the history of cryptocurrencies dates back to the 1980s, when David Chaum started Digicash. He used crypto to send money from one person to another, but still relied on banks to store the funds sent. Later, in 1998, Nick Szabo launched the concept of Bit Gold, which required users to solve cryptographic equations to earn digital currency rewards. Bit Gold is so similar to Bitcoin that some have speculated that Szabo could be Satoshi Nakamoto.

Since the launch of Bitcoin in 2009, many derivative cryptos have been created, such as Litecoin, which essentially copied the code of Bitcoin. Developers then began to create various crypto currencies with additional features and different structures, such as Ethereum in 2015. As crypto-currencies gained popularity, thousands more were created, and today there are nearly 20,000 crypto-currencies according to CoinMarketCap.

Cryptocurrency explained in a simple way

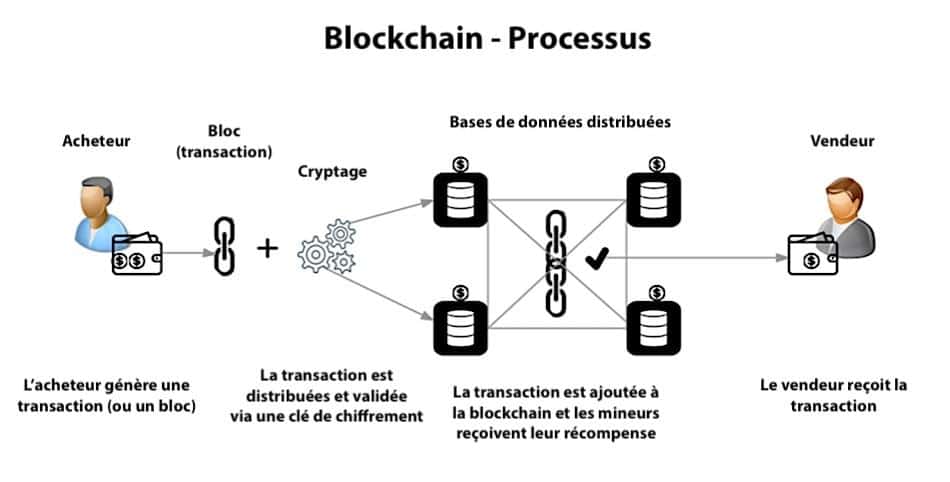

Despite the variety of crypto-currencies, they almost all work on the same foundation known as blockchain. So, to understand what a cryptocurrency is, we must first take a detour into blockchain technology and how it works.

What is blockchain?

A blockchain, as the name suggests, is a series of blocks that, when put together,form a chain. The blockchain is simply a database or ledger that keeps a record of all transactions made within it. For example, if you send 1 BTC to your friend, that transaction is recorded in the database. The Bitcoin blockchain, which is the oldest, is now over 400 GB in size and continues to grow with each transaction made.

But cryptocurrencies are not centralized, which means that there is no one computer that stores the entire database. Instead, the blockchain is shared among many computers around the world, and in the case of Bitcoin, there are over 70,000 computers on the network. Thus, once transactions have been recorded on a block, it is copied to other computers on the network, so that all computers have the same copy of the database.

This is what makes cryptocurrencies more or less secure, since it is impossible to attack all the computers on the network simultaneously. And if one user decides to modify his block, the majority will reject the modified version to ensure that they are all in sync. Moreover, it is also impossible to modify a block once a transaction is validated by the entire network. The process of securing the Bitcoin network is called mining. But it is not the only method of securing a blockchain.

Source : Trustmyscience

What is mining?

You may wonder why someone wouldn't try to modify their own block and then propagate it across the network, right? For example, crediting Bitcoins to their account! This is a legitimate question since, after all, we said that once a transaction is recorded in a block, it is copied to other computers. Well, let's talk about how the blockchain guarantees the validity of all blocks.

When you send 1 BTC to your friend, this entry is made in the database, but is still not validated. What happens is that the ledger entry is transferred to several other nodes in the network. A node is a computer in the network that maintains its copy of the database. Therefore, the transaction must be copied to a few nodes before it is considered "committed.

Then, once the required minimum number of nodes has been reached, the transaction is verified. Each block has a maximum size - the Bitcoin block size is 1 MB. And when the block reaches a size of 1 MB, a miner steps in to validate it and add it to the blockchain.

The method by which Bitcoin transactions are digitally verified on the Bitcoin network and added to the blockchain ledger is known as mining. It involves solving complex cryptographic hash equations to verify the blocks of transactions that are updated on the decentralized ledger of the blockchain.

At the same time, new crypto-currencies are created and transferred to the wallet of the miner who managed to find the solution to the equation, increasing the supply of digital tokens in circulation.

The recorded block is impossible to change, even with the most powerful computer in the world, and displays all previous transactions so that no one can ever change the record. This is why the blockchain is considered immutable.

It is important to note that this is the basic structure of a blockchain such as Bitcoin, but some cryptocurrencies have created different structures to improve speed, security or both. The transaction validation method described above, for example, is known as a proof-of-work (PoW) consensus mechanism, but newer cryptocurrencies use a proof-of-stake (PoS ) consensus mechanism that is less energy intensive.

So what is a cryptocurrency?

The simplest definition of a cryptocurrency is thatit is a form of digital currency. In short, it is an asset that is based on the blockchain, but does not physically exist. So when you own 1 Bitcoin, you just have a record on the blockchain linked to your cryptocurrency wallet.

The purpose of cryptocurrencies is to act as a medium of exchange, allowing users to transfer, say, money, on the blockchain more or less anonymously and without the interference of a central institution like a bank.

Other things you need to know about cryptocurrencies

The blockchain industry is not limited to cryptocurrencies. It also involves other structures to efficiently facilitate the exchange of cryptos, which brings us to wallets, exchanges, etc.

Cryptocurrency wallets

As seen above, a cryptocurrency is simply an entry in the database, but does not physically exist. So how can you claim to own, say, a Bitcoin if anyone can see it? Well, that's because each entry in the database is linked to a public key, which is associated with a specific account - yours.

A public key is a random string of numbers and letters associated with a crypto wallet. The wallet also has a private key. While the public key allows you to receive cryptos, it is the private key that allows you to transfer them from one wallet to another.

The wallet, on the other hand, is just software on your computer or smartphone that stores your public and private keys. Since cryptocurrencies are virtual, your cryptocurrency wallet is the only way to give you access to your holdings.

Cryptocurrency exchanges or exchanges

Miners earn rewards in the form of new cryptocurrencies on the blockchain, but the rest of us must either receive cryptocurrencies or buy them. Where to buy crypto-currencies? On a cryptocurrency marketplace, called a cryptocurrency exchange.

Cryptocurrency exchanges come in different forms, but the main ones are centralized exchanges (CEX). These are the ones that are controlled by a single company that holds cryptocurrencies for those customers.

The centralized exchange must have stocks of cryptocurrencies so that they can always have them when you need them. Binance, the most popular cryptocurrency exchange(Access Binance Tutorial), holds the largest amount of Bitcoins with 252,597 BTC, or about 1.32% of the total supply. In addition, the exchange should always be ready to accept cryptocurrencies so that you can sell your holdings in exchange for fiat currency.

Another type of exchange is thedecentralized exchange (DEX). This one does not keep a stock of cryptos, but rather uses smart contracts to facilitate transactions. The most popular DEXs have liquidity pools. A liquidity pool is a pool of cryptocurrencies from participants who make their cryptos available. Those with excess cryptos make them available to others. The pool is locked into a smart contract and is used to facilitate trading between cryptos on a DEX.

You will notice that DEXs only deal with crypto-currencies. So for now, you can't buy, for example, Bitcoin on a DEX using your credit card. You have to already own one form of cryptocurrency and then exchange it for another, perhaps by purchasing it from a CEX. This is why DEXs are not very popular with beginners.

But if you want to buy cryptocurrencies without going through a CEX and all its identity verification processes, peer-to-peer (P2P) exchanges are the way to go. These exchanges don't hold your cryptos either, but they do serve as a platform to connect buyers and sellers. Their main advantage is anonymity and sometimes you can get a better price than the market.

Decentralized Finance (DeFi)

This is perhaps the most interesting development in crypto and has been the main topic of discussion in 2021. As you might guess from its name, DeFi aims to create a decentralized financial system. For example, users can borrow and lend money on the blockchain without going through a bank. This is possible thanks to the cash that participants deposit on the lending protocols.

In this regard, we cannot talk about DeFi without mentioning the decentralized applications (dApp). These are the interfaces through which DeFi can take place. Since you don't want to involve a bank, there must be an interface through which you can navigate and access cash. Think of it as visiting a bank, except this one is blockchain-based.

Also, you can't navigate this world of dApps and DeFi with your email. This is the Web3. Web3 is accessed using a cryptocurrency wallet, which, as you now know, is the software that identifies you on the blockchain. Through your cryptocurrency wallet, you can buy cryptocurrencies and browse a variety of dApps to invest.

Non-fungible tokens (NFT)

NFTs are also assets issued from the blockchain. So we can say that they are a form of crypto-assets. The main difference with cryptocurrencies is that cryptos are, by their nature, fungible. NFTs, as their name suggests, are not.

One Bitcoin is equal to another Bitcoin, but one NFT is not equal to another NFT. Each is distinct, unique and valued differently based on its perceived value and demand.