While cryptocurrencies have been around in the world of investors and traders for many years, they have been slow to catch on with the tax authorities. Many areas were yet to be defined and regulated until January1 , 2019, when it became necessary to report one's cryptocurrencies.

In the period of tax return for income, it is therefore normal to wonder when and how you should declare your crypto-assets and their capital gains if there were any, especially since the legislation is constantly changing since 2020. Here we offer a guide to this effect to help you with your tax return.

While cryptocurrencies have been around in the world of investors and traders for many years, they have been slow to catch on with the tax authorities. Many areas were yet to be defined and regulated until January1 , 2019, when it became necessary to report one's cryptocurrencies.

In the period of tax return for income, it is therefore normal to wonder when and how you should declare your crypto-assets and their capital gains if there were any, especially since the legislation is constantly changing since 2020. Here we offer a guide to this effect to help you with your tax return.

Occasional or professional investor: which criteria?

This is an important issue, as the capital gains tax regime depends on it.

The tax authorities use various criteria to determine whether the taxpayer's investment activity is an occasional occupation, made in his own name, according to the "bundle of evidence" technique:

- By looking at the amounts that have been invested,

- Based on the number of transactions and their interval,

- The quantities exchanged,

- By observing the means used to carry out the transactions, such as robots or trading software,

- By verifying whether the taxpayer has any other professional activity (salaried or not) and

- The amount of the gain does not necessarily matter.

The tax authorities will look at the situation of each taxpayer on a case-by-case basis.

Professional investor

If the investor is considered a professional by the Tax Department, this has many financial and legal consequences:

- Have a SIREN number and have made all the declarations related to the existence of a company,

- Taxation according to the rules of the BIC - Industrial and Commercial Profits - until 2024 (income of 2023).

Occasional investor

An investor recognized as "occasional" by the tax authorities in his cryptocurrency investment activity will be taxed at the rate of 30%, or flat tax, on the capital gains he will have made, i.e. 12.8% tax + 17.2% social security levies.

As the tax legislation on crypto-assets stands, it is not possible to subject these capital gains to the progressive income tax scale. But this will change in 2024 (2023 income).

Now that we have clarified this, we need to define what is involved and how the surplus value is calculated.

Capital gains in the world of cryptos

Basic elements to consider a capital gain

Most of the time, on a crypto wallet or account, there are other counterparties to cryptocurrencies: currencies or fiat or stablecoins.

Fiat is the currency chosen by the state and issued by its Central Bank, while stablecoin is a cryptocurrency that is based on a tangible underlying (dollar, euro, gold). Stablecoin is a stable crypto currency and its price varies according to its underlying.

The following transactions are not affected by the capital gain:

- Exchange of one cryptocurrency for another in the wallet,

- Exchange of a cryptocurrency for a stablecoin in the wallet,

- The transfer of NFT - Non Fungible Token - and if

- The amount of sales is less than 304 € for 2021.

As soon as the cryptocurrencies leave the portfolio and are materialized in fiat, the capital gain or loss should be calculated.

The following transactions will be reportable, as they are subject to tax:

- Selling cryptocurrencies for fiat currency,

- Purchase of services, or goods, paid with cryptocurrencies,

- The benefits of mining (see below) and

- Other specific operations (lending and staking) related to decentralized finance (see below).

The particular calculation of the capital gain

According to the law, here is the calculation method for the capital gain on the disposal of crypto-assets:

disposal price - {total acquisition price x (disposal price/portfolio value)}

Thus, the total acquisition value of the entire crypto asset portfolio is taken into account.

You will therefore need to calculate the capital gain according to this formula for each security (cryptocurrency) that you have sold during the year. Capital gains and losses will add up to the total amount subject to tax.

Example of a transaction:

January 1 purchase of 2,000 euros of Bitcoin and 1,200 euros of Ethereum

February price increase:

Value held in Bitcoin = 4,200 euros

Value held in Ethereum = 1 800 euros

Our investor decides to sell 1,200 euros worth of Ethereum.

Calculation of the taxable gain :

| Purchase price | Value after increase | Sale price | |

| Bitcoin | 2 000 € | 4 200 € | - |

| of portfolio | 62,5 % | 70 % | |

| Ethereum | 1 200 € | 1 800 € | 1 200 € |

| of portfolio | 37,5 % | 30 % | |

| Value of the portfolio | 3 200 € | 6 000 € |

According to the above formula :

Capital gain = 1,200 - {3,200 x (1,200/6,000)*} = 1,200 - (3,200 x 0.2) = €560

*(1200/6000) = 0.2 or the disposal represents 20% of the portfolio

For information, this will result in a tax liability of 560 € x 30% = 168 €.

Other income related to cryptocurrency

The world of cryptos is vast and is definitely not just about trading or speculating on crypto-currencies. The various transactions generate new crypto-assets or income (interest). They are still in an ill-defined legal framework, but are still affected by taxation.

Mining

The crypto miner provides a service to the network of the chosen cryptocurrency. This is usually to confirm and secure transactions. The miner then receives compensation in cryptocurrencies for his work.

At present, the income received by the miners comes under the BNC regime - Non Commercial Profit.

Lending

A private person can lend an amount in cryptocurrencies for interest.

This interest is an income or gain received. It will be taxed at 30%, according to the flat tax.

To calculate the capital gain, when selling the crypto-currencies, the lending interest, paid in crypto-currency, is added to the total value of the portfolio and their acquisition value is estimated at €0.

Staking

All you have to do is own crypto-currencies in your portfolio and lock them into a "smart contract". And in exchange, you receive interest or, according to the cloud world, passive income.

Fiscally, the income generated, in cryptocurrency, is added to the digital wallet and its acquisition price is also considered 0 €.

Foreign Account Reporting Requirements

Since January1, 2019, declaration made in 2020, it is mandatory to declare its accounts or portfolios holding cryptocurrencies. Generally, these accounts, located on specialized platforms, are legally based abroad.

Therefore, it is necessary to report the holding of these accounts to the Tax Department, as soon as it is held since 2019.

Todo this, you must fill out a specific form, Cerfa 3916-BIS, where you must provide information for each account held abroad:

- The name of the platform

- The managing institution,

- Complementary designation,

- Your account number, usually your email address,

- Type of account (private - pro, joint account - single - collective),

- Opening date,

- Address of the company/platform.

Tip: it is possible to access this site to identify the addresses of the platforms

In case of non-declaration, you can be fined 750 € per undeclared account and have to pay an additional fine of 125 € for an omission or wrong information.

The tax authorities may know that you haven't reported your crypto accounts if you receive cash transfers to your current bank account from a cryptocurrency trading platform that are too high compared to your usual entries. Your bank has a duty to report these amounts to TracFin, the authority in charge of combating money laundering, tax fraud and terrorist financing.

When and how to declare capital gains on crypto assets

At income tax time, you need to include your income from cryptocurrency sales.

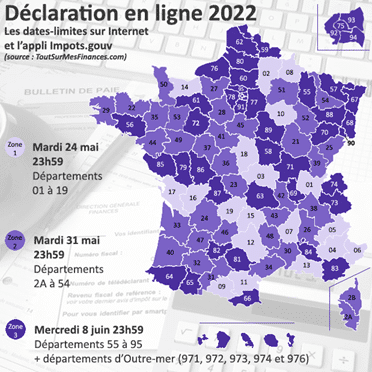

Online reporting deadlines for the 2022 return

The tax authorities have divided the French territory (including overseas territories) into three periods for declaring capital gains from cryptocurrencies:

Period 1 untilTuesday 24/05/2022 midnight for the departments 01 to 19,

Period 2 until Tuesday 31/05/2022 midnight for departments 2A to 54 and

Period 3 untilTuesday 08/06/2022 midnight for departments 55 to 976.

How to declare capital gains on cryptocurrencies?

In addition to the classic 2042 form, you will need to provide 3 other forms to accompany and explain your capital gains and losses and other income from your cryptocurrency transactions:

- The Cerfa 2042-C must include capital gains and losses in boxes 3 AN and 3BN. It allows you to declare additional income.

- The Cerfa 2086 schedule must also be completed. It details the amounts reported on the Cerfa 2042-C in boxes 3 AN and 3BN. This is certainly the most laborious and time-consuming part of the entire declaration, as it includes the detailed calculation of each capital gain or loss.

- Theannex Cerfa 3916 is dedicated to the declaration of accounts held abroad with all the details we mentioned above. There will be one declaration per account.

Reporting aids

But luckily, the platforms you go through to trade your crypto-currencies probably have simulators to help you with your tax return.

Otherwise, you can use the services of specialized software.

Waltio

Behind the software is a team of experts who will guide you through your declaration.

The Cerfa 2086 is offered to you pre-filled with a tax certificate.

This comes at a cost of course and Waltio offers different rates depending on the number of transactions made during the fiscal year (55 € up to 100 transactions, 159 € under 1 000 transactions and 249 € up to 10 000 transactions).

The online application is quick and easy.

Koinly

The application connects to your trading platform and wallets to synchronize the data. This will allow, then, to have an overview of the income from crypto-assets, calculate the capital gains and losses. It also takes into account the income from mining, staking and lending.

Koinly offers a free service with the basics. Then it goes from €49 up to 100 annual transactions, €99 up to 1,000 transactions, €179 below 3,000 transactions and €279 beyond.

The software is aimed at both professional and casual investors with a wide range of features. Beginners will find it easy to monitor their portfolio.

And Koinly is French.

Coqonut

Another French fintech, the app aims to make the taxation of crypto-assets simple.

The big advantage of Coqonut is that it has a single rate of €19.99 for the fiscal year with a huge range of services:

- Details of the calculations according to the tax rules for the Cerfa 2086 ;

- Takes into account all types of buy-sell transactions, sale of crypto for purchase of goods and services, deposits and withdrawals, staking, lending, etc. ;

- Takes into account all crypto-assets;

- Automatically synchronizes with all major trading platforms;

- As well as with the wallets and blockchains of the major cryptocurrencies;

- Issues a detailed statement in Excel format to explain the calculations.

There are other apps that can help with tax reporting regarding crypto assets, but these are the most popular.

You can also use a certified public accountant or a tax specialist who specializes in crypto-assets.

Conclusion ...

In any case, it is necessary to follow the tax news of the virtual currency world, because if the framework is set for the tax return. It is already known that changes will come with the next Finance Law.

If the Finance Law 2022, applicable from January1 , 2023, has set itself the goal of avoiding the tax adjustment of occasional investors rather active on virtual markets, more changes are expected in 2023 (2024 declaration on 2023 income). Still unclear points should be clarified, but the world of crypto-assets is evolving very quickly and the legislator may always find himself with a late law!